Vietnam’s Renewable Energy Market Heats Up: What’s Next for DPPA in 2025?

Under the backdrop of restructuring electricity market mechanisms in the Asia-Pacific region, Apala Group has launched a new article series, What’s Next?. This series aims to explore future trends in the renewable energy market across the region and provide key priorities for renewable energy buyers.

Southeast Asia continues to gain ground in renewable energy development, and 2025 is shaping up to be a pivotal year—especially for Vietnam. Following Thailand’s progress earlier this year with new mechanisms for off-site procurement, Vietnam has taken a major leap forward with long-anticipated reforms to its renewable energy purchasing framework.

Why Vietnam Matters

Vietnam is a major player in the global supply chain, home to large clusters of electronics and textile manufacturing. That makes it ground zero for brands looking to reduce emissions across their value chains—Scope 3 emissions. Until recently, however, renewable energy buyers in Vietnam were boxed into just two options: on-site installations or buying unbundled I-RECs.

However, international buyers are placing increasing emphasis on additionality, which means they are seeking real, new renewable projects, rather than relying solely on credit. That pressure has been building for years, and finally, after nearly a decade of work, Vietnam’s Direct Power Purchase Agreement (DPPA) mechanism is on the verge of going live.

What’s New in 2025?

In 2017, USAID and Vietnam’s Ministry of Industry and Trade (MoIT) began developing the DPPA pilot. In 2024, the pilot program was rolled out under Decree 80/2024/ND-CP, laying the groundwork. Fast forward to March 2025: the government has now launched the official DPPA framework under Decree 57/2025/ND-CP.

So, can DPPA procurement begin? Almost.

Decree 57: What Changed?

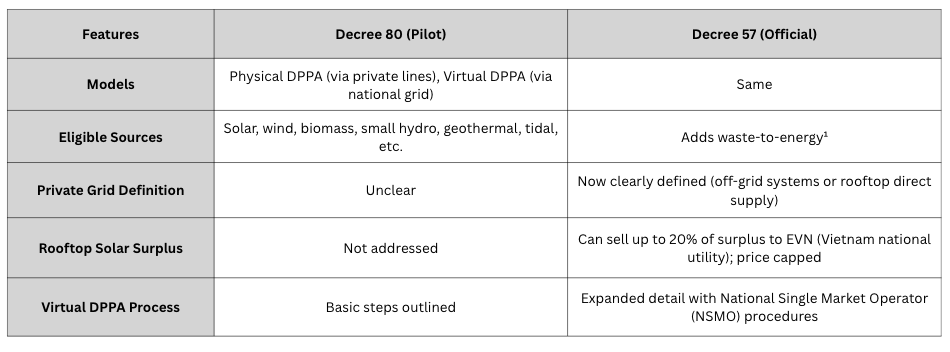

Decree 57 keeps the core structure of the pilot, but adds clarity, structure, and legal backing—especially for the Virtual DPPA model.

Key Differences Between the Pilot (Decree 80) and the Official Framework (Decree 57)

¹ Waste-to-energy refers to the process of generating electricity from waste materials produced through industrial, commercial, and everyday activities.

So, What’s Next?

While Decree 57 gives DPPA a legal green light, there’s still a to-do list before the market can function smoothly. Here are the key focus areas to watch:

1. Clear Operational Rules

MoIT needs to issue detailed implementation guidelines on:

Who can register and how

How pricing works—especially for Virtual DPPAs (e.g., Contract for Difference, also called CfD)

How renewable energy generators will be dispatched through the national grid

2. Private Grid Projects: Still Tricky

Decree 57 defines what counts as a “private grid,” but building one still involves complex hurdles:

Licensing

Investment approvals

Construction permits

Environmental regulations

These could slow the growth of off-grid physical DPPAs.

3. Virtual DPPA Rollout: Real Test Starts Now

NSMO outlines a four-step process (document prep, alignment, requirement checks, registration), but real-world implementation is where challenges will show up:

How fast will approvals move?

Will large consumers and generation corporations (GENCOs) coordinate effectively with EVN?

Will it scale beyond the usual suspects?

4. Rooftop Solar: Small Gains, Big Questions

Producers using private lines can now sell up to 20% of surplus power to EVN. That’s a step forward—but key details are missing:

How will metering work?

How will prices be calculated and settled?

What tech standards will apply?

5. New Renewable Energy Sources: Waste-to-Energy Joins the Party

Waste-to-energy is now eligible under DPPA. How these projects will participate—off-grid vs. grid-connected—remains to be seen.

Future Challenges: What Could Go Wrong?

Even with a framework in place, several challenges could still slow or complicate DPPA implementation:

Grid Readiness: Vietnam must ensure its grid can handle new renewable energy volumes, especially for Virtual DPPAs.

Contract Complexity: Virtual DPPAs involve CfDs and multiple stakeholders. Legal clarity and bankability are key to attracting financing.

Policy Risk: Decree 57 warns about potential misuse. Oversight and transparency will be crucial.

Regulatory Alignment: Grid-connected projects must align with PDP8 (Vietnam’s National Power Development Plan). The role of off-grid rooftop solar in PDP8 is still unclear.

Market Preparedness: RE developers and large energy consumers must be ready to participate—technically and financially.

Price Volatility: Even with CfDs, participants remain exposed to market swings. That could limit uptake if not managed well.

A Promising Start, But Work Ahead

Decree 57 marks a major milestone for Vietnam’s renewable energy market. It transforms years of pilot testing and stakeholder collaboration into a formal mechanism that could unlock a new wave of clean energy investment.

But success isn’t guaranteed. Execution matters now—especially clear rules, smooth coordination, and financial viability. If those pieces fall into place, Vietnam could become a regional pioneer in off-site renewable energy procurement.

Stay tuned—because 2025 might just be the year DPPA goes from policy to practice.