Science-Based Targets: Turning Climate Ambition into Corporate Strategy

Founded in 2015, the Science Based Targets initiative (SBTi) emerged as a collaborative effort to mobilize the private sector around the goals of the Paris Agreement. Established through a partnership between the Carbon Disclosure Project (CDP), the United Nations Global Compact, the World Resources Institute (WRI), the World Wide Fund for Nature (WWF), and the We Mean Business Coalition, the SBTi was created to bridge the gap between climate science and corporate action.

Over the past decade, it has evolved into one of the most influential organizations shaping global climate ambition, providing companies with a clear, science-based framework to define and validate emission reduction targets. Today, the SBTi operates as an independent UK-registered charity with a dedicated validation subsidiary, ensuring transparency, consistency, and credibility in the target-setting process.

Its mission is simple yet transformative: to align private-sector emissions reductions with the level of decarbonization required to keep global temperature rise below 1.5 °C.

Why Science Matters in Climate Action

The Intergovernmental Panel on Climate Change (IPCC) emphasizes that every fraction of a degree matters: limiting global warming to 1.5 °C marks the boundary between manageable disruption and irreversible climate damage with profound social and economic consequences.

The SBTi translates this scientific consensus into a practical framework for businesses, enabling them to turn high-level climate commitments into quantified, time-bound emission reduction pathways.

Through science-based targets (SBTs), companies determine how much and by when they must reduce their greenhouse gas (GHG) emissions across their entire value chain. By setting near-term and net-zero targets, companies shift from making climate pledges to demonstrating measurable, science-aligned progress toward a low-carbon future.

Global Momentum: The Business Case for Science-Based Targets

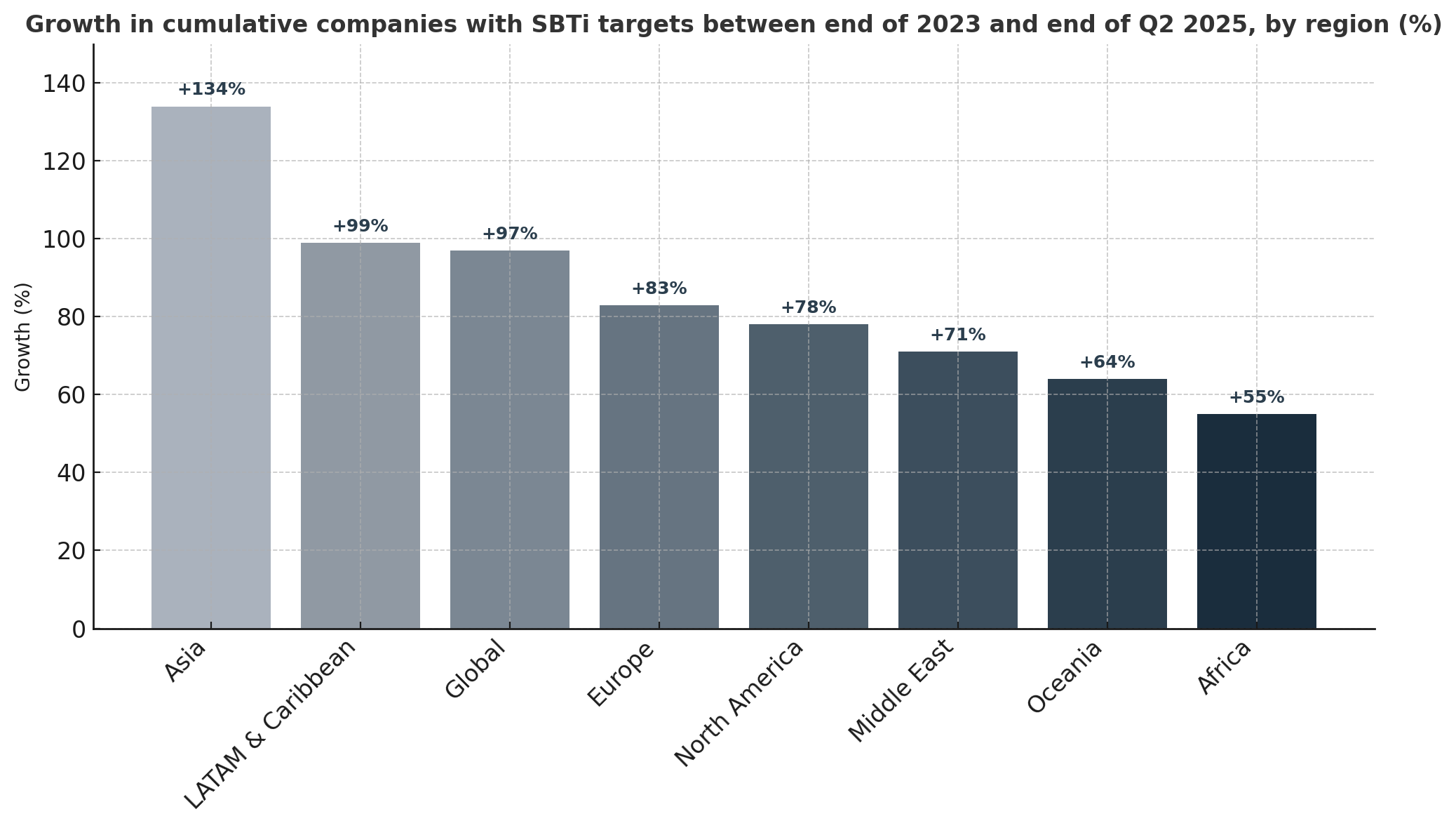

As of November 2025, more than 11,900 companies and financial institutions have set or have committed to setting Science-Based Targets, a surge that now represents over 40% of global market capitalization and around 25% of global revenue. According to the latest SBTi Trend-Tracker between January 2024 and June 2025, the number of companies setting near-term targets rose by 97%, while those adopting both near-term and net-zero targets increased by an impressive 227%. Asia recorded the highest proportional growth at 134%, driven particularly by expanding participation in China, while the Industrials, Consumer Goods, and Materials sectors led adoption globally. Together, these trends demonstrate that science-based climate commitments are becoming a core element of corporate strategy, marking a decisive shift from niche sustainability efforts to mainstream, decarbonization-driven business transformation.

Source: SBTi Trend-Tracker 2025

This surge reflects a broader recognition that climate action is no longer a moral choice, it’s a business imperative linked to competitiveness, resilience, and investor confidence.

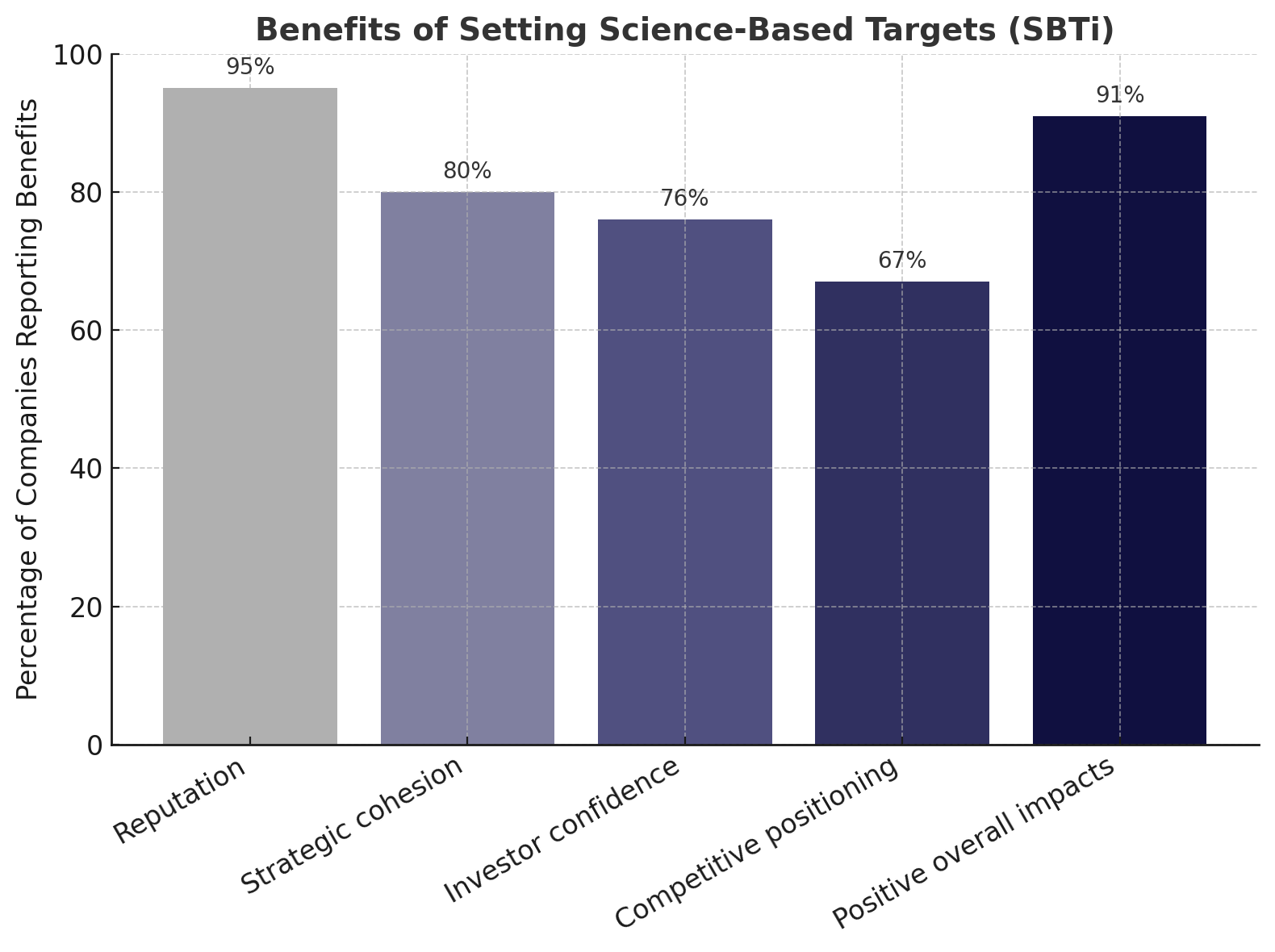

Historically, companies that set these targets early have benefited from improved brand reputation, better investor confidence, and cost savings through operational efficiency. Adopting science-based targets allows companies to clearly align their emissions reductions with the latest climate science and thereby become more resilient and competitive. Companies not only respond to past and present trends, but also position themselves strategically for the future low-carbon economy. Recent surveys developed by the Science Based Targets of participating companies reveal compelling benefits:

Source: SBTi Impact Report 2025

Across regions, the SBTi Impact Report 2025 reveals that setting science-based targets delivers consistently positive outcomes, though motivations and challenges vary by context. European companies lead in adoption and report the strongest gains in reputation, investor confidence, and regulatory alignment, supported by frameworks like the EU Green Deal and CSRD. In North America, SBTs are increasingly driven by investor expectations and disclosure mandates, strengthening governance and access to capital despite persistent Scope 3 challenges. The Asia-Pacific region shows rapid growth (particularly in Japan, South Korea, and Australia) as companies use SBTs to meet export requirements and global supply-chain standards. Meanwhile, Latin American companies, though newer to the process, view SBTs as a pathway to international competitiveness, improved strategic vision, and stronger stakeholder trust. Together, these regional trends demonstrate that SBTs are not only advancing global decarbonization but also reshaping corporate performance, innovation, and resilience across markets.

These numbers confirm what sustainability leaders already know: aligning with science is good for business. SBTs help companies anticipate regulation, cut operational costs, develop low-carbon products, and attract capital aligned with Environmental, Social, and Governance (ESG) criteria.

How Companies Are Cutting Emissions

Companies today are cutting emissions through a mix of operational improvements, innovation, and systemic changes across their value chains. The first and often most immediate step involves improving energy efficiency; upgrading lighting and HVAC systems, modernizing machinery, optimizing production processes, and using digital monitoring tools to track and reduce energy waste. These measures not only lower emissions from direct operations (Scope 1 and 2) but also yield cost savings, making them an effective business case for climate action.

Another major trend is the shift to renewable energy and electrification. Many companies are investing in on-site solar installations, entering power purchase agreements (PPAs) for wind or solar energy, or purchasing renewable energy certificates to cover their electricity use. At the same time, companies are replacing fossil-fuel-based equipment and vehicle fleets with electric alternatives and electrifying heating and cooling systems. These actions drastically cut carbon footprints while aligning operations with global decarbonization goals.

Beyond their own facilities, leading companies are focusing on supply chain and materials optimization, since value chain emissions (Scope 3) often represent the majority of total emissions. Businesses are collaborating with suppliers to reduce their carbon intensity, sourcing materials locally to cut transport emissions, redesigning packaging, and improving logistics efficiency. This systems-level approach not only reduces emissions but also strengthens supplier relationships and supply chain resilience.

At the organizational level, companies are adopting internal carbon pricing and integrating climate considerations into governance, investment, and innovation decisions. By assigning a financial value to carbon emissions, companies can steer internal budgets and strategies toward low-carbon solutions. Complementing these structural shifts are behavioral measures reducing travel through remote work and virtual meetings, promoting sustainable commuting, and minimizing waste across offices and operations.

Finally, while the focus remains on direct emission reductions, some companies use carbon offsets to address residual emissions that are currently hard to eliminate. This often involves supporting reforestation, soil carbon, or carbon capture projects, though best practice dictates that offsets should complement, not replace, emission reduction efforts.

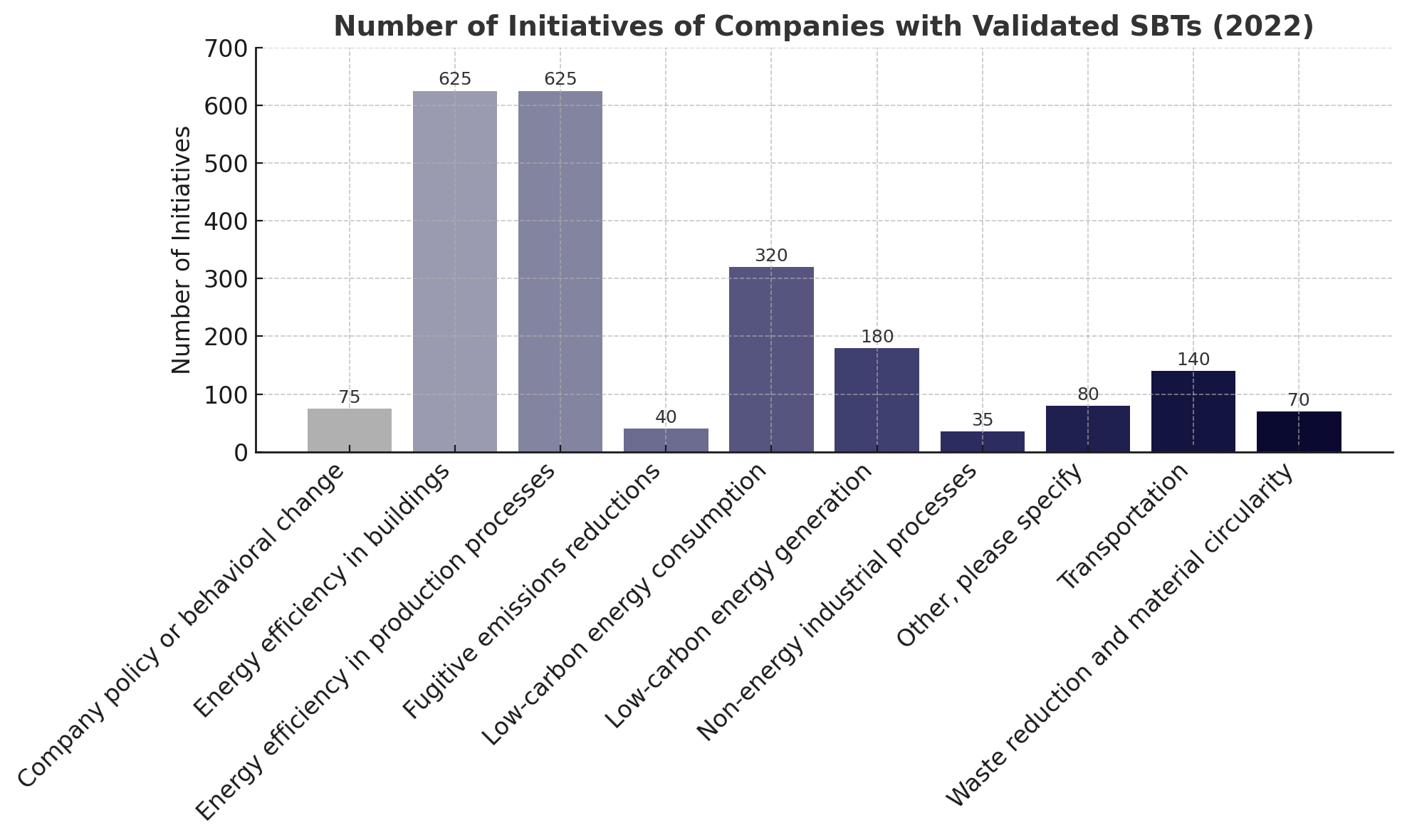

A CDP analysis of 440 high-impact disclosing companies with approved science-based targets identified over 2,100 emission-reduction initiatives in 2022, dominated by the following strategies:

Source: Carbon Disclosure Project, SBT Implementation Report 2022

While many initiatives focus on cost-saving efficiency, leading companies are embedding climate innovation into product design, logistics, and procurement; turning sustainability into a driver of growth. Together, these approaches reflect how corporate climate strategies have evolved from isolated efficiency initiatives in the past to comprehensive, science-based decarbonization pathways today. Companies are now recognizing that cutting emissions is not just a moral or compliance issue, it’s a strategic necessity for competitiveness, resilience, and long-term growth in a low-carbon economy.

As an early climate action example, HEINEKEN set its first SBTs in 2021, aiming to achieve net zero across its value chain by 2040. Since then, the targets have served as a unifying “north star” across the company, integrating climate action into everyday decision-making and aligning departments such as supply chain, procurement, finance, and sustainability around shared goals. By working closely with suppliers, supporting renewable energy adoption, and encouraging them to set their own science-based targets, HEINEKEN has extended its impact beyond direct operations to drive systemic change across its value chain. According to HEINEKEN’s 2024 Report, 56 suppliers have set emissions reduction targets, and to further accelerate renewable energy uptake across its supply chain, HEINEKEN co-launched the REfresh Alliance, a partnership with 10 beverage companies aimed at supporting suppliers in transitioning to renewable electricity. HEINEKEN has achieved a 34% reduction in Scope 1 and 2 emissions by 2024 compared to its 2022 baseline, progress mainly achieved by increasing renewable electricity use to over 84% and investing in renewable heat solutions for its breweries. Additionally, to advance its Scope 3 agricultural goals, the third season of the company’s low-carbon farming programme is driving nearly 300 pilot projects testing sustainable practices such as cover cropping, no-tillage, improved organic matter use, and optimized seed and fertilizer application. Guided by collaboration, integration, and prioritization, HEINEKEN has embedded sustainability into the fabric of its business, turning ambition into measurable progress. This steady, practical progress reflects HEINEKEN’s and the SBTi’s shared belief that meaningful transformation is driven by consistent, collective action toward a resilient, low-carbon future.

From Commitment to Validation: The SBTi Process

The Science Based Targets initiative provides a structured framework for companies to set greenhouse gas reduction goals that align with the latest climate science and the Paris Agreement’s aim to limit global warming to 1.5°C. The process typically follows five main steps:

Commitment: A company formally commits to setting a science-based target by submitting a letter of intent to the SBTi. This signals to stakeholders its intention to align its emissions reductions with scientific benchmarks.

GHG inventory calculation: The company establishes a baseline year (no earlier than 2015) and quantifies emissions across Scopes 1, 2, and 3 following the GHG Protocol guidelines.

Near-term and long-term target setting: Near-term (NT) targets must be between 5–10 years from the date the targets are submitted to the SBTi for an official validation; NT targets should have a minimum 4.2% annual absolute reduction in Scopes 1 & 2 and 2.5% annual absolute reduction for Scope 3. Long-term (Net Zero) targets are not mandatory but strongly encouraged to set, the target year must be between 10 years from the date the targets are submitted and 2050 at the latest; with a 90% absolute reduction ambition for all scopes.

Target submission and validation: Companies must register and submit their targets through the SBTi Validation Portal, a digital platform that streamlines registration and review.

Communication and disclosure: Once validated, companies must publicly announce their targets within six months and report progress annually, often through annual sustainability reports or other reporting frameworks like CDP, GRI, or TCFD. Targets can later be recalibrated to reflect updated science or corporate changes.

The entire validation process typically takes one to two months and culminates in public listing on the SBTi’s “Companies Taking Action” page.

Absolute vs. Sector-Based Approaches

To set targets, the SBTi allows two main methodologies:

Absolute Contraction: every sector reduces emissions by the same percentage over time (useful for diversified portfolios).

Sectoral Decarbonization Approach (SDA): heavy-emitting sectors must follow specific sector guidelines towards defined emissions intensity reductions (e.g., t CO₂ per tonne of cement or steel) by 2040–2050.

These models anchor corporate ambition in carbon-budget logic, ensuring that global mitigation efforts remain consistent with planetary boundaries.

Because decarbonization challenges differ by industry, the SBTi complements its cross-sector standards with sector-specific guidance for heavy emitters and relevant sectors. Among the most critical are:

Buildings: The sector accounts for 6% of global CO₂ emissions. The SBTi Buildings Guidance outlines pathways for materials, energy use, and embodied carbon in construction.

Financial Institutions (FI): Given their central role in capital allocation, the SBTi FI Guidance enables banks, asset managers, and insurers to set science-based targets across lending, investment, and insurance portfolios. It establishes methodologies for portfolio coverage and temperature alignment, helping redirect finance flows toward low-carbon and climate-resilient activities.

Forest, Land and Agriculture (FLAG): One of the most carbon intensive sectors according to the IPCC 2022 Report, representing 22% of global GHG emissions stemming from land-use change and agriculture. The FLAG Guidance introduces methods for tackling deforestation, soil carbon, livestock emissions, and agroforestry sequestration.

Power Sector: With 34% of global greenhouse gas emissions, electricity and heat production underpins all other sectors’ decarbonization. The SBTi Power Sector Guidance is being updated but the current criteria provides clear pathways for companies to align with a 1.5°C trajectory through renewable energy deployment, fossil fuel phase-out, and grid decarbonization. It introduces methods to account for both direct generation emissions and those from purchased and resold electricity.

Each sector framework translates the 1.5 °C trajectory into actionable metrics (tonnes CO₂e per unit of output or activity) so that progress can be tracked with rigor and comparability.

Continuous Improvement: Version 2.0 on the Horizon

The SBTi serves as a key connector between global climate goals and corporate action, providing a science-based framework for setting and validating emission-reduction targets aligned with limiting warming to 1.5°C. Within the broader sustainability ecosystem, SBTi ensures credibility and consistency, helping companies move from voluntary pledges to measurable, science-aligned outcomes. It also complements other leading frameworks that businesses often use in parallel, such as CDP for disclosure, the GHG Protocol for emissions accounting, and TCFD for climate-related risk reporting; these frameworks create coherence across sustainability strategies. By aligning with these initiatives, the SBTi reinforces transparency, accountability, and ambition, driving companies toward credible decarbonization and leadership in the transition to a low-carbon economy.

The SBTi is currently revising its Corporate Net-Zero Standard to ensure it remains credible, robust, and aligned with the latest climate science. First released in 2021, the original standard was a pioneering framework that defined what corporate net zero means in practice and set consistent criteria for long-term decarbonization. However, rapid advances in climate science, policy, and corporate practice have made an update essential to reflect new insights and address implementation challenges identified by companies. Version 2.0 will:

Reflect updated IPCC and IEA pathways.

Strengthen value-chain (Scope 3) requirements.

Introduce a continuous-improvement cycle.

Simplify structure and enhance interoperability across standards.

Give more guidance on Environmental Attribute Certificates.

This update will help companies transition from one-off commitments to ongoing, adaptive decarbonization embedded in strategic planning.

Challenges for Companies in SBTi Implementation

The SBTi is more than a reporting framework, it represents a strategic compass guiding businesses through the greatest transformation of our time, aiming to face climate change.

For companies, adopting science-based targets (SBTs) means embedding resilience, credibility, and innovation at the heart of their business model. For investors and consumers, it signals integrity and alignment with a liveable planet. It is clear that setting and implementing SBTs is a powerful way for companies to align with global climate goals, but it also presents several challenges.

One of the most significant difficulties lies in data quality and availability, especially for Scope 3 emissions, which include all indirect emissions from a company’s value chain. Many companies struggle to collect accurate and consistent data from suppliers, transport providers, or product users, as this information is often fragmented or not standardized. Suppliers (especially in developing countries) may lack the capacity, knowledge, or incentives to measure and reduce their emissions. That is why coordinating decarbonization efforts across a global supply chain to obtain reliable data and implement decarbonization strategies is crucial for companies.

Another major challenge is the technical complexity of SBTi methodologies. Companies must interpret and apply detailed guidance based on the GHG Protocol and, in some cases, sector-specific frameworks. The SBTi periodically updates its requirements, for example, it now requires a different allocation of bioenergy emissions, forcing companies to review and potentially revise their existing targets. This process demands specialized expertise and resources that many companies, particularly smaller ones, may not have in-house. Internally, companies often face organizational and governance challenges. Aligning SBTi goals with broader business strategy requires coordination among departments such as operations, finance, and procurement. Limited climate literacy and the absence of clear accountability structures can hinder progress. In some cases, sustainability teams operate in isolation, making it difficult to embed emissions reduction targets into corporate decision-making and performance metrics.

In addition, policy and market uncertainty can affect planning and investment. In some regions, unclear or unstable regulatory frameworks (such as inconsistent carbon pricing, limited access to renewable energy, or weak enforcement) make it harder to plan long-term decarbonization pathways. Companies that operate across multiple jurisdictions must navigate a patchwork of policies, sometimes facing the risk of “carbon leakage” if production shifts to regions with looser environmental standards.

Finally, there are reputational and transition risks. Once a company publicly commits to SBTi targets, it faces increased scrutiny from investors, consumers, and civil society. Failing to meet targets, or being perceived as overstating progress, can harm its reputation and raise accusations of “greenwashing.” As SBTi criteria evolve, companies may also find their earlier targets outdated or non-compliant, forcing them to revise their goals publicly.

In short, while SBTi participation signals strong climate leadership, it also requires deep organizational commitment, technical expertise, and sustained investment. The most successful companies are those that integrate emissions reduction into core business strategy, build transparent data systems, engage suppliers proactively, and remain adaptive to changing science and policy expectations.

Supporting Solutions with Apala Group

Apala Group supports companies throughout their science-based target journey by addressing the key challenges that often hinder effective implementation. Through its advisory and technical services, Apala helps companies strengthen data quality and emissions measurement systems, aligning them with the GHG Protocol, SBTi requirements and best international standards. We provide capacity building and tailored training to improve internal governance, ensuring climate goals are embedded across departments and decision-making processes. Apala also assists in supply chain engagement and Scope 3 management, working with suppliers and partners to build data capabilities and promote decarbonization collaboration. To overcome financial and market barriers, our team designs blended finance mechanisms and connects clients with green investment opportunities that make decarbonization both feasible and cost-effective. Additionally, Apala supports transparent reporting and robust Measurement, Reporting, and Verification systems, as well as disclosures aligned with frameworks that complement the SBTi, including the Task Force on Climate-related Financial Disclosures (TCFD), Global Reporting Initiative (GRI), International Financial Reporting Standards (IFRS), and Carbon Disclosure Project (CDP). These frameworks help companies communicate their progress credibly, manage reputational risks, and position themselves as leaders in the low-carbon transition.

| Challenge | Typical Impact | How Apala Supports |

|---|---|---|

| Data and measurement (Poor data quality, Scope 3 gaps) | Inaccurate baselines | Apala Group strengthens clients’ emissions data systems by aligning them with the GHG Protocol and SBTi standards. This involves designing and implementing digital MRV (Monitoring, Reporting & Verification) tools, supporting supplier data collection, and conducting third-party data validation to ensure reliable baselines and progress tracking. |

|

Complex methodologies and evolving criteria |

Need for revalidation | Apala provides technical advisory and scenario modeling to help companies interpret SBTi methodologies and adapt to new criteria. The team supports target submissions up to validation, climate scenario analysis, and sector-specific strategy alignment to ensure continued compliance and credibility. |

| Financial challenges to implement decarbonization (High capex, limited ROI) | Slow implementation | Apala designs blended finance strategies and connects companies with green investors, concessional capital, and carbon finance opportunities. We help clients build strong financial cases for decarbonization projects by quantifying co-benefits such as energy efficiency and risk mitigation. |

| Supply chain engagement | Limited Scope 3 reductions | Apala facilitates supplier engagement programs, helping companies implement climate targets across their value chains. Through training, data tools, and supplier partnerships, Apala strengthens Scope 3 measurement and builds collaborative pathways to reduce emissions. |

| Governance and training | Weak internal alignment | Apala offers capacity-building workshops and supports companies in embedding climate goals into governance structures, KPIs, and corporate strategy. We also provide leadership engagement and climate literacy programs to align internal teams around SBTi commitments. |

| Policy/Market uncertainty | Difficulty forecasting | Apala conducts policy and market assessments to identify risks and opportunities in each region. Our market experts help clients develop flexible, scenario-based decarbonization strategies and engage in policy dialogues to anticipate regulatory shifts and maintain competitiveness. |

| Reporting and tracking progress | Transparency risks | Apala assists in building integrated ESG and carbon reporting systems, aligned with SBTi, TCFD, and CDP standards. The team helps clients establish clear MRV frameworks and produce transparent disclosures that demonstrate credible progress toward science-based targets. |

| Reputational risks | Greenwashing risk | Apala supports strategic climate communication by ensuring claims are data-driven and verifiable. We help companies develop transparent reporting narratives, manage reputational risks, and publicly communicate progress in line with evolving sustainability requirements and SBTi guidance. |

In 2025 and beyond, the question is no longer “Should we set a science-based target?”, it’s “How quickly can we align our operations with science and lead the way to net-zero?”

In this decisive decade for climate action, companies have a crucial role to play in accelerating the shift toward a net-zero and nature-positive economy. Partnering with Apala Group allows companies to transform climate commitments into measurable, science-based results; building resilience, unlocking new market opportunities, and strengthening stakeholder trust. Now is the time for businesses to move from intention to impact, and Apala Group stands ready to be a strategic ally in turning ambition into real, lasting climate leadership.